hard money lenders in Atlanta Georgia Specializing in Property Renovations

hard money lenders in Atlanta Georgia Specializing in Property Renovations

Blog Article

Discovering the Benefits and Dangers Connected With a Hard Money Lending

Navigating the complex world of actual estate funding, investors commonly experience the alternative of a Hard Money Finance. The vital lies in recognizing these facets, to make an informed choice on whether a Hard Money Financing fits one's financial approach and danger resistance.

Comprehending the Essentials of a Hard Money Finance

What exactly is a Hard Money Lending? Unlike conventional financial institution fundings, tough Money finances are based mostly on the worth of the property being acquired, instead than the borrower's credit scores rating. These financings are normally used for investment functions, such as home flipping or advancement jobs, instead than individual, residential use.

Secret Advantages of Opting for Hard Money Loans

Potential Dangers and Disadvantages of Tough Money Loans

Despite the eye-catching benefits, there are some significant dangers and downsides connected with difficult Money finances. These financings typically include high rates of interest, often double that of typical lendings. This can cause financial strain if not taken care of effectively. Additionally, difficult Money car loans usually have shorter payment periods, generally around 12 months, which can be testing for customers to fulfill. Additionally, these finances are frequently protected by the consumer's residential or commercial property. If the borrower is not able to settle the Financing, they take the chance of shedding their residential property to foreclosure. Hard Money loan providers are much less managed than conventional lending institutions, which look at these guys might reveal customers to click now unethical lending methods. While difficult Money car loans can supply quick financing, they additionally lug significant dangers.

Instance Situations: When to Consider a Hard Money Lending

Comparing Tough Money Loans With Various Other Funding Options

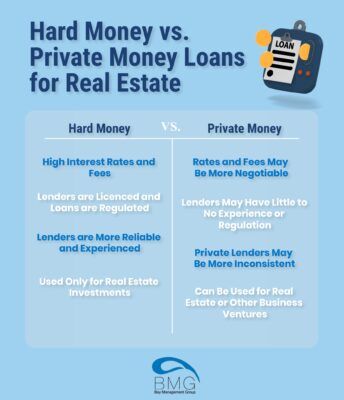

Exactly how do hard Money lendings compare to other funding options? When compared with conventional loans, tough Money lendings use a quicker authorization and financing procedure because of fewer regulations and demands. However, they commonly come with higher passion rates and fees. On the other hand, small business loan offer reduced rates of interest but have stringent qualification requirements and a slower authorization time. Personal financings, on the various other hand, deal versatility in terms yet might lack the framework and safety and security of hard Money finances. Finally, crowdfunding and peer-to-peer read here borrowing systems offer a special choice, with competitive rates and simplicity of accessibility, however might not be suitable for larger financing requirements. The choice of funding depends on the debtor's details needs and situations.

Final thought

To conclude, tough Money fundings offer a practical service genuine estate investors needing swift and versatile financing, especially those with credit scores difficulties. Nevertheless, the high rate of interest and much shorter payment durations demand mindful factor to consider of potential threats, such as foreclosure. It's essential that customers completely review their monetary strategy and threat tolerance prior to choosing for this sort of Finance, and contrast it with other funding alternatives.

Unlike typical financial institution loans, tough Money financings are based mostly on the worth of the property being acquired, instead than the debtor's credit history rating. These fundings often come with high passion prices, often dual that of traditional financings. In scenarios where a debtor desires to stay clear of a prolonged Finance process, the much more straightforward hard Money Finance application can supply a much more hassle-free choice.

When contrasted with standard finances, difficult Money loans offer a quicker authorization and financing procedure due to fewer needs and laws - hard money lenders in atlanta georgia. Exclusive loans, on the various other hand, offer adaptability in terms but might do not have the framework and safety and security of tough Money fundings

Report this page